Failed payments are a major challenge for businesses, with up to 70% of transactions failing in some cases, leading to revenue loss and customer churn. Traditional methods often rely on rigid schedules and generic outreach, which fail to address specific payment issues. AI offers a smarter approach by analyzing payment data, predicting recovery opportunities, and tailoring retry strategies.

Key Takeaways:

- AI boosts recovery rates by 23% and reduces recovery time by 90%, turning a 10-day process into just 1 day.

- Dynamic retry logic based on decline reasons reduces costs and improves success rates.

- AI-driven systems cut operational expenses by up to 70% and reduce manual recovery costs from $45 to $15 per account.

- Multi-channel engagement ensures personalized outreach, improving customer response rates.

- AI-powered tools help prioritize high-value accounts, automate routine tasks, and streamline compliance.

By combining predictive analytics, real-time insights, and tailored communication, AI transforms payment recovery into a faster, more effective process.

AI in Payment Decline Prediction

Using Predictive Analytics to Identify Decline Patterns

AI takes payment decline prediction to a whole new level by analyzing thousands of data points – far beyond the 5–15 factors typically used in traditional models, like credit scores or invoice age. It dives deeper, factoring in elements such as payment velocity, spending habits, digital behavior, and even broader economic trends like regional employment rates and inflation.

Take Stripe‘s Payments Foundation Model as an example. This model, trained on tens of billions of transactions, processes hundreds of signals – from bank identifiers and ZIP codes to the sequence of transactions – to make real-time predictions. In 2024 alone, Stripe recovered over $6 billion in legitimate declined transactions, thanks to AI-powered retry logic.

"We’re moving from point-in-time credit scoring to continuous credit monitoring that can detect financial stress signals weeks or months before they manifest in traditional data."

– Dr. Thomas Wei, Lead Data Scientist, FICO

Propensity to Pay (P2P) models take this even further. Instead of relying on static snapshots, these models continuously monitor risk signals, pulling from diverse data sources like credit bureau records and utility payment histories. This approach can improve predictive accuracy by as much as 20%. P2P models generate dynamic risk scores that evolve with customer behavior, offering a more accurate and timely view of financial risk.

These insights are essential for identifying and prioritizing opportunities to recover payments effectively.

Prioritizing High-Value Recovery Opportunities

AI doesn’t just identify potential payment issues – it also helps prioritize recovery efforts. By ranking accounts based on recovery likelihood and financial impact, AI creates a risk-ranked task queue, enabling teams to focus on the most promising cases instead of relying on outdated "aging bucket" methods. It also segments customers into categories like on-time payers, slow payers, and high-risk accounts, while distinguishing between those facing genuine financial hardship ("can’t pay") and those deliberately avoiding payment ("won’t pay").

For example, one financial services company saw a 25% increase in recovery rates after replacing generic campaigns with AI-driven outreach. Another organization integrated AI-powered collections into its CRM system, cutting time-to-collect by 26% without adding extra staff.

The results speak for themselves: advanced AI models can increase collection rates by 25%, lower operational costs by up to 40%, and slash the cost-to-collect by 50%. Combining AI with human expertise delivers even better results, achieving recovery rates 22% higher than fully automated or manual methods.

Optimizing Retry Strategies with AI

Dynamic Retry Logic Based on Decline Reasons

AI takes a smarter approach to handling declined transactions by analyzing the reasons behind them. For instance, "soft" declines – caused by issues like insufficient funds or temporary technical errors – are flagged for retries. On the other hand, "hard" declines – stemming from problems like stolen cards, lost cards, or revoked authorizations – are skipped entirely, avoiding unnecessary processing fees on retries that are unlikely to succeed.

Timing also plays a critical role. AI identifies the best moments to retry based on patterns like bank behaviors and transaction metadata. For example, debit card transactions are more likely to succeed at 12:01 AM in the customer’s local time zone when daily spending limits reset. By factoring in signals like device usage and bank-specific trends, AI can better predict when retries are most likely to work.

Instead of sticking to a one-size-fits-all schedule – like retrying every three days – AI adapts dynamically. It spaces retries at least five days apart to reduce customer frustration and maintain a positive relationship. As Dave Ruda, VP of Product at Billtrust, explains:

"Static dunning schedules are the strategic equivalent of casting a giant net in the same spot every day and just hoping for a good catch".

This flexible strategy doesn’t just improve success rates; it also sets the stage for meaningful cost reductions.

Reducing Costs Through Targeted Retries

AI’s ability to fine-tune retry intervals and focus on actionable signals leads to better outcomes and lower costs. For example, when it identifies hard declines like "stolen_card" or "revocation_of_authorization", it halts retries altogether, cutting down on unnecessary transaction fees and reducing the cost per customer contact by as much as 70%.

One financial services company saw a 25% increase in recovery rates by replacing generic campaigns with AI-powered strategies. By using predictive analytics to score accounts and recommend tailored approaches, they transformed their recovery process.

The impact? Recovery timelines are shortened by two to four times, and the entire process becomes up to 90% faster. When you let AI take the reins, you’re not just working harder – you’re working smarter.

AI-Driven Multi-Channel Customer Engagement

Personalized Outreach Across Multiple Channels

AI takes customer communication to a whole new level by analyzing individual behavior patterns. Whether someone prefers responding to texts, opening emails, or answering phone calls, AI pinpoints the best way to reach them. For instance, if emails go unread but SMS gets a response, the system might follow up a morning email with a timely text to increase engagement. With SMS boasting a 42% open and read rate compared to email’s 32%, it’s an especially effective tool for urgent reminders like payments.

Timing is another area where AI shines. It can predict the best time to connect – whether that’s during lunch, after work, or on weekends. While traditional phone calls often struggle with low contact rates of just 8–10%, AI’s ability to combine smart timing with the right channel dramatically boosts response rates.

Increasing Team Efficiency with Automation

AI doesn’t just enhance customer outreach – it also makes internal operations more efficient. Virtual agents and chatbots can handle up to 80% of routine inquiries, such as checking balances, confirming payments, or setting up simple payment plans, all while being available 24/7. This round-the-clock support ensures that customers get immediate assistance.

For more complex issues, AI seamlessly hands off cases to human agents, providing them with all the necessary context to resolve the matter quickly. As the Moveo AI Team explains:

"AI collection agents are no longer a futuristic idea; they’re a practical, proven solution for organizations seeking to improve recovery rates, reduce operational costs, and deliver better customer experiences".

The results speak for themselves: businesses have seen up to a 40% increase in payment arrangements and a 50% drop in collection costs. By the end of 2025, it’s expected that over 70% of financial institutions will integrate AI at scale for debt recovery, with chatbots managing 75% of customer interactions during these processes.

EXL Agentic AI Collections: Multi-Agent Voice Solution for Smarter Debt Recovery

sbb-itb-647c22e

Key Metrics and ROI of AI in Payment Recovery

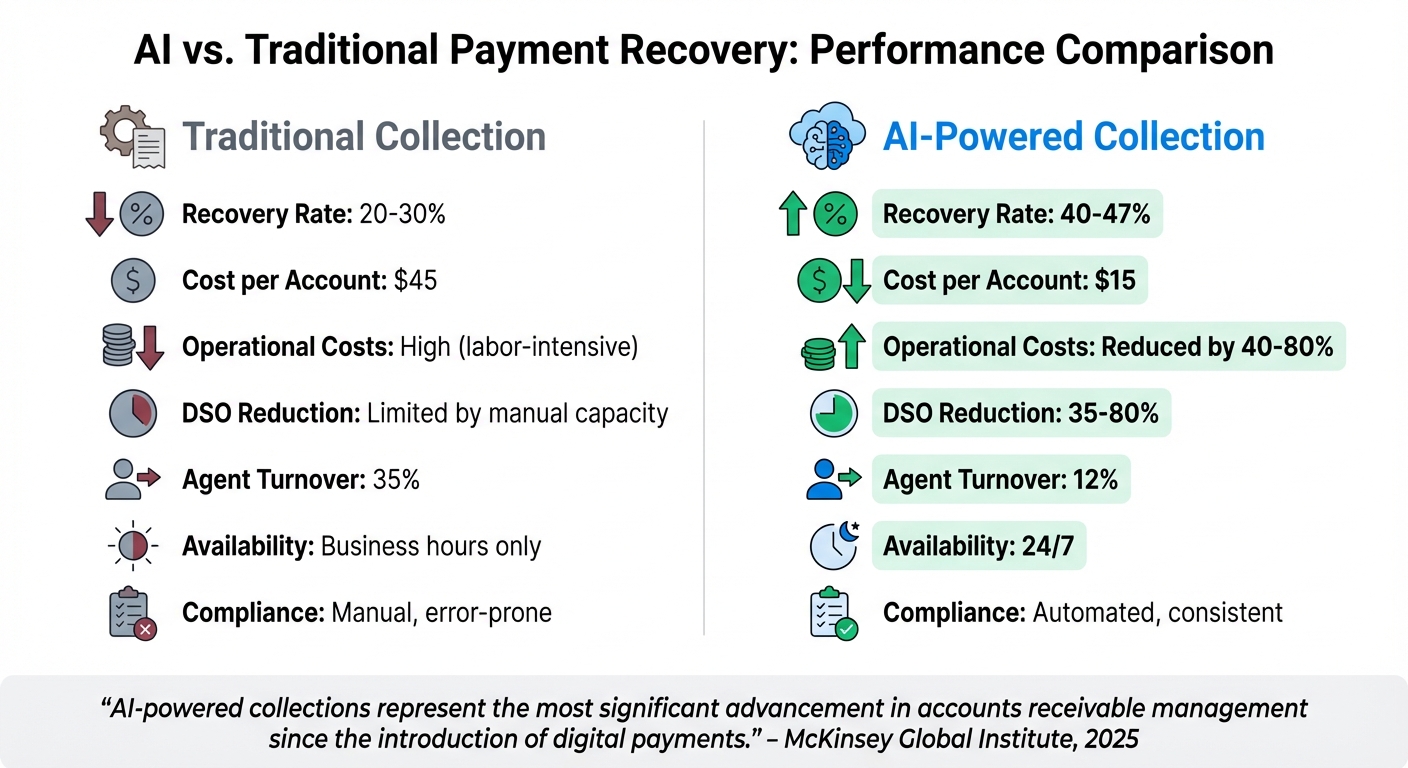

AI vs Traditional Payment Recovery: Performance Metrics Comparison

Performance Metrics and Benchmarks

AI-driven collection systems are proving to be game-changers, with recovery rates soaring by 47% higher compared to traditional methods. This leap forward isn’t just about better results – it’s also about cutting costs. AI reduces operational expenses by 40–80%, slashing the cost per account from $45 to $15.

One of the standout benefits is the reduction in Days Sales Outstanding (DSO), which can drop by 35% to 80% when AI is applied. For example, FourKites achieved a 26% decrease in time-to-collect, showcasing the measurable impact of AI. Similarly, TSI Financial Services improved recovery rates by 25% by leveraging predictive analytics to prioritize accounts based on payment likelihood.

Operational efficiency skyrockets with AI as well. Manual follow-ups see a 95% reduction, and agents gain back two hours daily for other tasks. Compliance also gets a boost – violation rates drop from 12% to 2% when AI ensures adherence to regulations like the FDCPA. Over a three-year period, organizations using AI report an impressive 136% average ROI. These metrics highlight how AI reshapes payment recovery, offering results that traditional methods simply can’t match.

AI vs. Manual Methods: Performance Comparison

The contrast between AI-powered and manual recovery systems is striking. While traditional methods rely on static rules and limited working hours, AI adapts in real-time and operates round the clock. Here’s how the two stack up:

| Metric | Traditional Collection | AI-Powered Collection |

|---|---|---|

| Recovery Rate | 20–30% | 40–47% |

| Cost per Account | $45 | $15 |

| Operational Costs | High (labor-intensive) | Reduced by 40–80% |

| DSO Reduction | Limited by manual capacity | 35–80% |

| Agent Turnover | 35% | 12% |

| Availability | Business hours only | 24/7 |

| Compliance | Manual, error-prone | Automated, consistent |

McKinsey Global Institute summed it up perfectly in 2025:

"AI-powered collections represent the most significant advancement in accounts receivable management since the introduction of digital payments. The technology has transformed what was once a labor-intensive, error-prone process into a precise, efficient, and highly effective operation."

These advancements underline how AI is redefining the landscape of payment recovery, delivering precision, efficiency, and results at a scale traditional methods simply can’t achieve.

Implementing AI for Payment Recovery

Integration and Setup Process

You don’t need to overhaul your entire system to integrate AI into your payment recovery process. Simply connect tools like your accounting software (e.g., QuickBooks, Xero), CRM platforms (like Salesforce), and billing systems to create a comprehensive view of customer payment behavior. Start by analyzing historical payment data to establish a baseline. Then, configure the core logic: set up routing rules, customize retry logic based on specific decline reasons (e.g., insufficient funds versus fraud blocks), and define escalation paths for different risk levels. Some AI-powered recovery platforms make this process incredibly efficient, with initial setup taking less than 15 minutes using a CSV upload or direct software integrations.

Once set up, deploy adaptive workflows that adjust outreach strategies in real time. These workflows can modify the tone of communication, the channel used (SMS, email, or IVR), and even the timing based on customer engagement. Dynamic segmentation further refines efforts, focusing on actual payment behaviors rather than generic rules. Customers are grouped into low, medium, or high-risk categories, ensuring recovery efforts are highly targeted. With this structured approach, your system is ready to transition into ongoing performance monitoring for continuous improvement.

Monitoring Performance and Making Adjustments

After the setup is complete, it’s vital to monitor your AI system and refine strategies as needed. Use real-time dashboards to centralize data from billing, CRM, and accounting systems. These dashboards help track critical metrics like Days Sales Outstanding (DSO), Collections Effectiveness Index (CEI), and Average Days Delinquent (ADD).

Incorporate feedback loops to analyze every customer interaction – whether it’s an email open, a click, a reply, or a payment. This allows the system to continually learn and improve, identifying which strategies work best for different customer segments. Implement anomaly detection to spot issues early, setting up alerts for deviations in conversion rates or other KPIs. When the AI flags an account as high-risk, prioritize it for personal attention, even if the account isn’t significantly overdue yet.

Dig deeper into what’s working by identifying which specific actions – like a reminder email, SMS, or phone call – led to successful payments. This level of precision allows you to fine-tune your approach. Businesses that have adopted AI-powered targeting have reported a 25% increase in recovery rates, replacing outdated one-size-fits-all campaigns with smarter, data-driven strategies.

SixtySixTen‘s AI-Powered Automation for Revenue Recovery

Custom AI Workflows for Dunning Management

SixtySixTen takes revenue recovery to the next level by using its proprietary automation tools to create tailored workflows for B2B SaaS companies. By combining low-code/no-code platforms like n8n and Zapier with custom-coded solutions, they ensure precision where off-the-shelf tools fall short. These workflows don’t just stop at sending generic payment reminders – they adjust dynamically based on how customers respond to payment outreach. For example, if a customer opens a reminder email but doesn’t complete the payment, the system might switch to a different communication channel or tweak the tone of future messages to improve engagement.

This system seamlessly integrates billing platforms, CRM tools like Salesforce, and accounting software such as QuickBooks, creating a single source of truth that consolidates payment patterns, communication preferences, and customer histories. Additionally, SixtySixTen’s AI agents specialize in payment recovery tasks, such as scoring accounts by risk level, personalizing outreach timing, and escalating high-value cases for human intervention. These workflows operate as an extension of your existing systems, providing real-time insights and actionable strategies.

Centralized Data and Real-Time Dashboards

SixtySixTen also simplifies data management by unifying fragmented billing and CRM datasets into real-time dashboards powered by platforms like Google Looker and PowerBI. These dashboards give you a live view of key performance metrics, helping you monitor the effectiveness of your recovery strategies as they unfold.

A standout feature of these dashboards is their ability to automate compliance monitoring. They flag potential regulatory issues – like those governed by the FDCPA – before they become problems, helping your team stay ahead of legal requirements. With centralized data, your team can spend less time on manual reporting and focus more on managing high-value recovery cases. As one Beam AI client shared:

"The AI-driven system has significantly streamlined our operations. It keeps our human teams in full control while improving the speed, quality, and consistency of our workflows."

Conclusion

With advanced AI workflows and real-time dashboards, the future of payment recovery is already here. AI turns payment recovery into a precision-focused revenue engine, delivering up to 47% higher recovery rates while slashing operational costs by 70%. By analyzing customer behavior in real time, AI adjusts timing, tone, and communication channels automatically, ensuring smarter, more effective recovery efforts.

The financial benefits are undeniable. Companies using AI-driven recovery solutions experience 23.4% higher repayment rates compared to traditional manual methods. These systems run 24/7, guaranteeing no missed follow-ups and allowing teams to concentrate on high-value negotiations instead of routine administrative work. This shift highlights how AI can transform collections into a strategic driver of revenue growth.

For B2B SaaS companies, SixtySixTen’s custom AI workflows offer a game-changing approach. By seamlessly integrating billing platforms, CRM tools, and accounting software into unified dashboards, these solutions eliminate data silos and provide real-time insights into recovery performance. The result? A system that adapts to each customer’s payment habits, ensures compliance, and strengthens relationships – all while turning collections into a strategic advantage.

FAQs

How does AI decide the best time to retry a failed payment?

AI leverages sophisticated predictive models to evaluate factors such as a customer’s payment history, time zone, and preferred payment methods. By analyzing these patterns, it identifies the best moments to retry a failed payment, increasing the likelihood of success.

For instance, AI might detect that a customer tends to have enough funds available on a particular day of the week or at a specific time of day. By timing retries to align with these favorable moments, businesses can recover more payments while reducing unnecessary friction for customers.

How does AI help lower the cost of recovering payments?

AI helps cut payment recovery costs by automating repetitive tasks and tailoring communication to better connect with customers. Using predictive analytics, it can pinpoint high-risk accounts, enabling teams to concentrate their efforts where they’ll have the most impact.

On top of that, AI-powered tools work around the clock, removing the need for constant manual input. This can slash operational expenses by up to 80% compared to older methods. The result? Faster recovery processes, improved efficiency, and lower overall costs.

How does AI decide which accounts to focus on for payment recovery?

AI leverages sophisticated algorithms to assess delinquent accounts and generate priority scores instantly. These scores take into account various factors, such as payment history, the age of outstanding invoices, account value, customer characteristics, and even regional trends. By processing this data, AI ensures that recovery efforts are focused on accounts with the highest value or the greatest risk.

This precise method allows businesses to use their resources more efficiently, boosting recovery rates while reducing the time and effort required.